Essential Best Practices For Payment Fraud Prevention

As digital transactions soar, the threat of payment fraud looms larger than ever. Businesses face increasing pressure to protect their assets and customer information. Implementing effective fraud prevention best practices is vital for maintaining transaction security and customer trust. This guide explores essential strategies that can significantly reduce your risk of payment fraud.

Understanding Payment Fraud

Types of Payment Fraud

Payment fraud comes in various forms, each with unique implications for businesses. Here are some common types:

- Credit Card Fraud: Unauthorized use of someone else's credit card information.

- Phishing: Scammers trick individuals into revealing personal information.

- Chargeback Fraud: Customers dispute legitimate transactions, leading to losses for merchants.

According to the European Banking Authority, online payment fraud has increased by 20% over the last year. Understanding these threats is the first step toward effective fraud prevention.

Best Practices for Fraud Prevention

1. Implement Strong Identity Verification

Identity verification is crucial for ensuring that customers are who they claim to be. Use multi-factor authentication (MFA) to add an extra layer of security.

Example: A leading e-commerce platform, Shopify, requires users to verify their identity via SMS or email before making significant changes to their accounts. This simple step has drastically reduced unauthorized access.

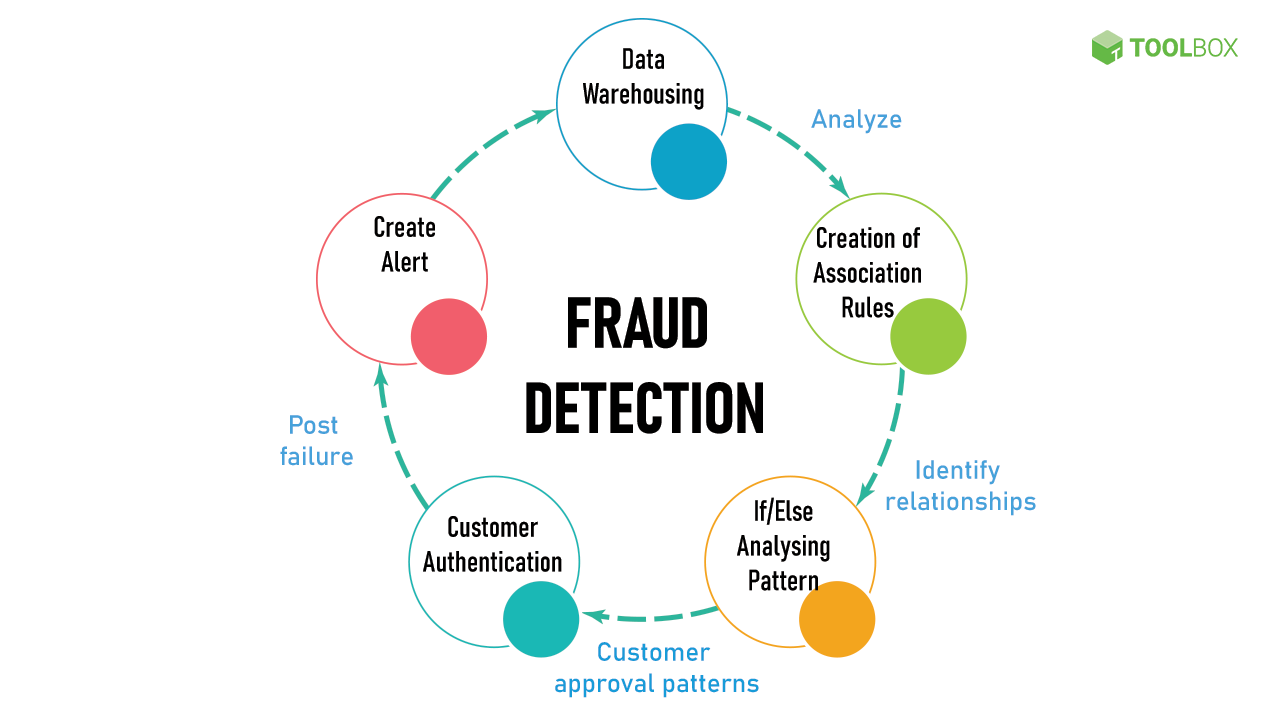

2. Utilize Advanced Fraud Detection Tools

Invest in robust fraud detection tools that employ machine learning to analyze transaction patterns. These tools can flag suspicious activities in real-time.

Example: PayPal uses sophisticated algorithms to monitor transactions, identifying potentially fraudulent ones before they are completed. This proactive approach has minimized their fraud rates significantly.

3. Conduct Regular Risk Assessments

Regular risk assessments help identify vulnerabilities in your payment processes. Use these assessments to refine your fraud prevention strategies.

Example: An online retailer might discover that certain payment methods are more prone to fraud. By adjusting their payment options, they can mitigate risks effectively.

Tools and Technologies for Fraud Detection

Machine Learning Applications

Machine learning technology can analyze vast amounts of transaction data and detect anomalies that indicate fraud.

Example: Companies like Kount use AI to assess the risk level of transactions in real time, allowing businesses to make informed decisions about whether to approve or decline a purchase.

Real-Time Fraud Monitoring

Real-time monitoring of transactions can help catch fraud before it affects your bottom line.

Example: Stripe offers real-time monitoring services that alert businesses to suspicious activities, enabling immediate action.

Case Studies: Successful Fraud Prevention

Case Study 1: Amazon

Amazon employs an extensive fraud detection system that analyzes user behavior patterns. This approach has led to a significant decrease in fraudulent transactions.

Case Study 2: eBay

eBay uses robust identity verification processes, including two-step authentication, which has greatly reduced account takeovers and fraudulent listings.

Case Study 3: Zappos

Zappos implemented real-time fraud monitoring tools that analyze every transaction, resulting in a 30% reduction in fraud cases over two years.

Case Study 4: Shopify

Shopify's commitment to customer security includes a comprehensive fraud analysis tool, which has helped merchants identify suspicious activities before they escalate.

Case Study 5: PayPal

With its advanced algorithms, PayPal has successfully reduced fraudulent transactions by over 25% by analyzing patterns and flagging suspicious behaviors.

Conclusion

Implementing fraud prevention best practices is essential for safeguarding your business against payment fraud. By focusing on identity verification, utilizing advanced detection tools, and conducting regular risk assessments, you can significantly enhance your transaction security. As fraud tactics evolve, so should your strategies. Don’t wait—start adopting these practices today to protect your business and your customers. For more insights into effective fraud prevention, explore our detailed resources.