Navigating Auto Insurance Rates: A Comprehensive Comparison Guide

Understanding auto insurance rates is essential for any driver. With the right knowledge, you can secure a policy that meets your needs without breaking the bank. In this guide, we’ll explore how to compare auto insurance rates effectively, the factors that influence premiums, and how you can save money through discounts and strategic choices.

Introduction to Auto Insurance Rates

Auto insurance rates determine how much you will pay for coverage. They can vary significantly based on various factors, making it crucial to understand these elements before purchasing. By knowing how to compare auto insurance rates, you can save money and find the best policy for your situation.

Understanding Auto Insurance Policies

Auto insurance is designed to protect you financially in the event of an accident or damage to your vehicle. There are various types of policies, each offering different coverage options. Understanding these can help you make informed choices.

Types of Auto Insurance Policies

- Liability Coverage: Covers damages to others if you’re at fault in an accident.

- Collision Coverage: Pays for damage to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents like theft or natural disasters.

By knowing the types of coverage, you can tailor your policy to fit your needs while ensuring you’re not overpaying for unnecessary features.

Factors Influencing Insurance Rates

Several key factors can influence your auto insurance premiums. Understanding these can help you anticipate costs and make adjustments to lower your rates.

Key Factors Affecting Premiums

- Driving History: A clean driving record often results in lower rates.

- Vehicle Type: Some cars are more expensive to insure than others.

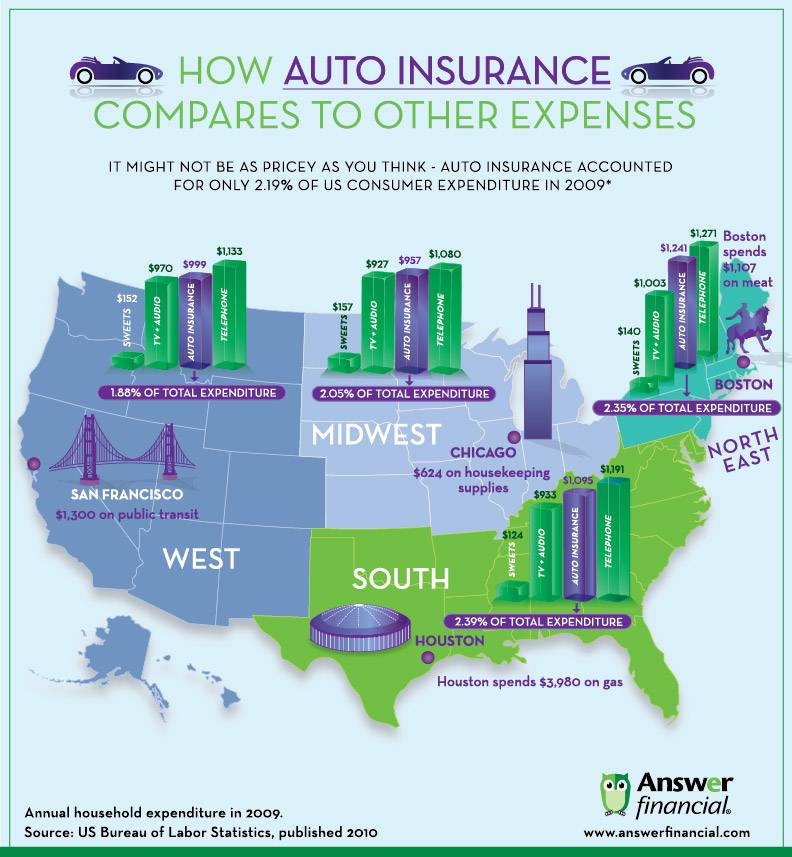

- Location: Urban areas tend to have higher rates due to increased accident risks.

- Age and Gender: Younger drivers usually face higher premiums, and gender can also play a role.

- Credit Score: Insurers often consider credit history when determining rates.

Recognizing these factors allows you to take steps to potentially lower your insurance costs.

How to Compare Auto Insurance Rates

Comparing auto insurance rates effectively can seem daunting, but it’s a straightforward process. Here are actionable steps to help you navigate it.

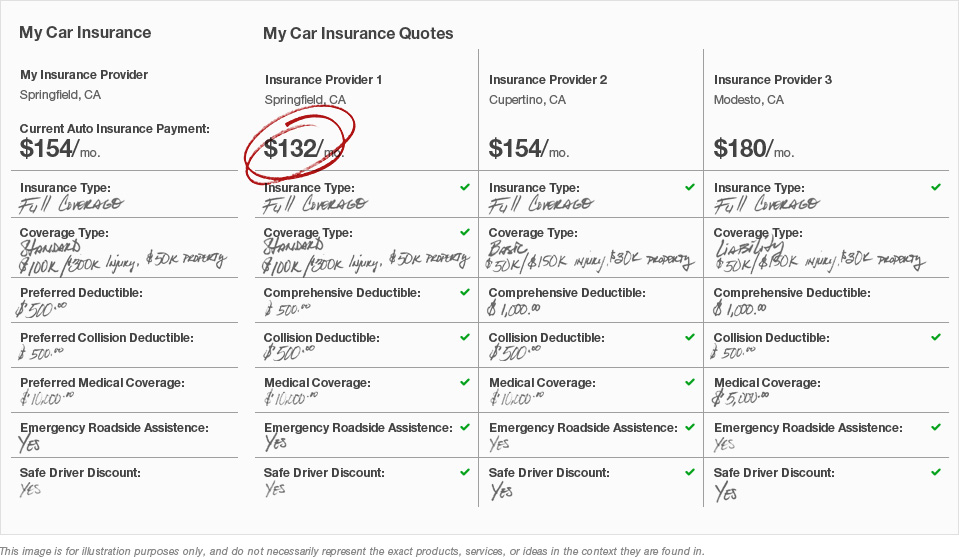

Steps to Compare Rates

- Gather Quotes: Collect quotes from multiple insurers to get a clear picture.

- Evaluate Coverage Options: Ensure that you are comparing similar coverage levels.

- Check for Discounts: Look for potential discounts that can reduce your premium.

- Consider Customer Service: Research customer reviews and ratings for each insurer.

Online Comparison Tools

Using online comparison tools can simplify the process. Websites like NerdWallet or the Insurance Information Institute allow you to input your information and receive quotes from several insurers, making it easier to compare rates side by side.

Benefits of Using Jake from State Farm

Jake from State Farm has become synonymous with reliable insurance service. Choosing State Farm comes with several advantages, particularly in customer service and claims processing.

Why Choose State Farm?

- Customer Service Ratings: State Farm consistently ranks high in customer satisfaction surveys.

- Efficient Claims Process: Many users report quick and hassle-free claims experiences.

- Variety of Discounts: They offer numerous discounts for safe driving, bundling policies, and more.

By opting for a well-known provider like State Farm, you can feel more confident in your insurance choice.

Conclusion

In conclusion, understanding auto insurance rates is vital for anyone looking to purchase coverage. By comparing quotes, recognizing the factors that influence premiums, and taking advantage of discounts, you can find a policy that suits your needs without overspending. Don't hesitate—start comparing auto insurance rates today to secure the best deal possible!

Now that you're equipped with this knowledge, take the next step: gather your quotes, evaluate your options, and find the best auto insurance for you!