Unlocking Financial Freedom: Opportunities In Decentralized Finance

Decentralized finance (DeFi) is transforming the financial landscape, offering unprecedented opportunities for individuals and investors. This innovative sector utilizes blockchain technology to provide financial services without traditional intermediaries. As DeFi continues to grow, understanding these opportunities becomes essential for anyone looking to enhance their financial freedom. In this article, we’ll explore decentralized finance opportunities, the role of influential figures like Sam Bankman-Fried, and how you can get started in this exciting space.

Introduction to Decentralized Finance

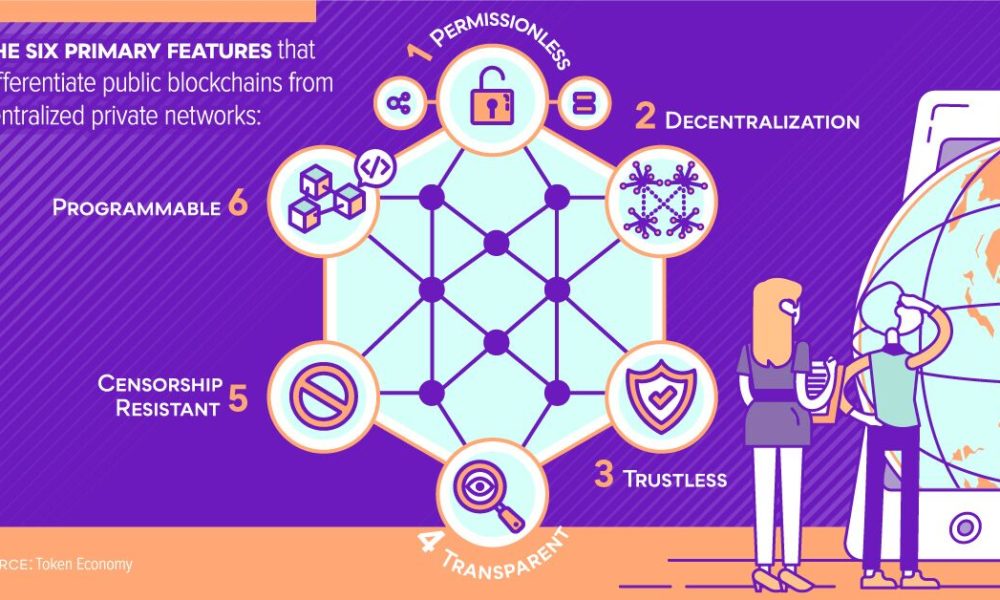

Decentralized finance refers to a financial ecosystem built on blockchain technology, which allows users to access financial services such as lending, borrowing, and trading without relying on central authorities like banks. This paradigm shift empowers individuals, granting them greater control over their finances. The rise of DeFi has facilitated innovations such as smart contracts, which automate transactions and enhance security. As the DeFi market continues to expand, recognizing the opportunities within this space is crucial for anyone looking to invest.

The Role of Sam Bankman-Fried in DeFi

Sam Bankman-Fried, the founder of FTX and Alameda Research, has significantly influenced the DeFi landscape. His contributions have spurred interest and investment in decentralized platforms. Under his leadership, FTX became a key player in cryptocurrency trading, introducing innovative features that attracted millions of users. Bankman-Fried’s commitment to transparency and education has also helped demystify the complexities of DeFi for newcomers. For instance, projects like Serum, which he co-founded, have streamlined trading processes and enhanced interoperability among different blockchain platforms.

Opportunities in Decentralized Finance

Yield Farming

One of the most popular DeFi investment opportunities is yield farming. This process allows users to lend their cryptocurrency to earn interest. Platforms like Aave and Compound enable investors to earn attractive returns on their assets. For example, in 2021, some yield farmers reported annual percentage yields (APYs) exceeding 100%, attracting significant attention from both novice and experienced investors.

Liquidity Pools

Liquidity pools are another lucrative opportunity within DeFi. By providing liquidity for trading pairs on decentralized exchanges like Uniswap, users can earn a share of transaction fees. This model incentivizes liquidity provision, creating a more efficient trading environment. For instance, liquidity providers on Uniswap can earn fees proportional to their contributions, with some pools generating annual returns of 20% or more.

Staking

Staking involves locking up cryptocurrency to support network operations, such as transaction validation. In return, stakers receive rewards, making it an attractive investment opportunity. Platforms like Cardano and Polkadot offer staking options with competitive rewards. As the DeFi sector matures, staking is expected to become a more prominent investment strategy.

Risks and Challenges of DeFi

While decentralized finance offers numerous opportunities, it is not without risks. Security vulnerabilities in smart contracts can lead to significant losses, as seen in various hacks and exploits. For example, the Poly Network hack in 2021 resulted in over $600 million in stolen assets, highlighting the need for caution.

Regulatory challenges also pose risks. Governments worldwide are still figuring out how to regulate DeFi, which could impact the market's growth. Investors must stay informed about evolving regulations to navigate this complex landscape effectively.

Getting Started with DeFi

Entering the decentralized finance space may seem daunting, but it is manageable with the right approach. Here’s a simple guide to get started:

- Educate Yourself: Familiarize yourself with basic DeFi concepts and terminology.

- Choose a Wallet: Select a cryptocurrency wallet that supports DeFi platforms, such as MetaMask or Trust Wallet.

- Acquire Cryptocurrency: Purchase popular cryptocurrencies like Ethereum or stablecoins to use in DeFi applications.

- Explore DeFi Platforms: Research platforms like Uniswap, Aave, or Compound to find investment opportunities that suit your risk tolerance.

- Start Small: Begin with small investments to understand the mechanics before committing larger amounts.

Conclusion

Decentralized finance opportunities are reshaping the financial landscape, offering unique ways to invest and grow wealth. While the potential for high returns exists, it’s essential to understand the associated risks. By educating yourself and exploring platforms like those mentioned, you can navigate this innovative space effectively. Embrace the world of decentralized finance opportunities today, and take the first steps toward financial freedom. For more insights and updates, consider subscribing to our newsletter.