Understanding The Impact Of Esg On Portfolio Performance

In recent years, Environmental, Social, and Governance (ESG) criteria have transformed the investment landscape. Investors are increasingly aware that sustainable practices can lead to enhanced financial performance. This article explores the impact of ESG on portfolio performance, emphasizing how integrating these criteria can benefit investors both ethically and financially.

What is ESG and Its Relevance to Portfolio Performance?

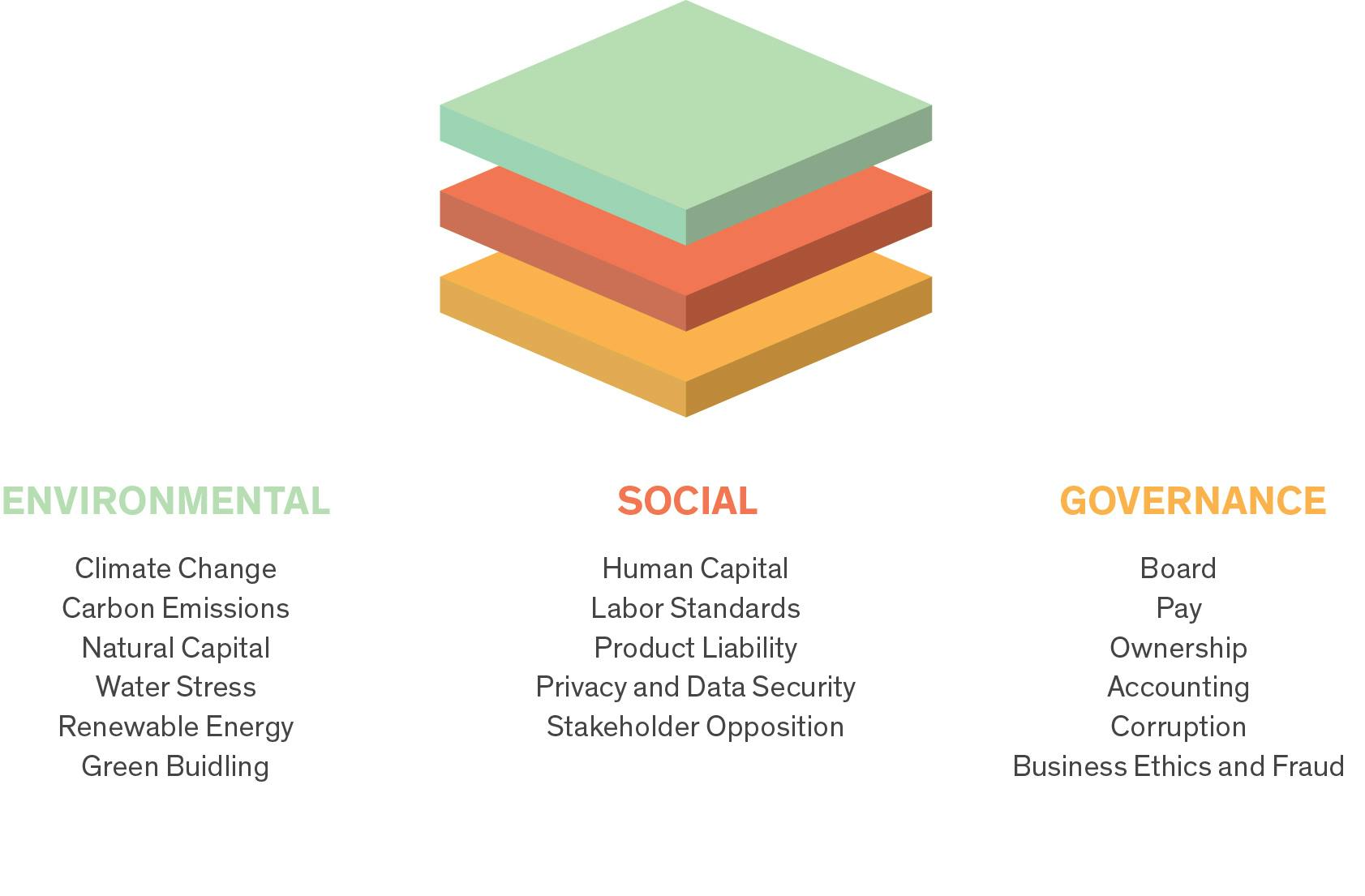

ESG refers to a set of standards for a company’s operations that socially conscious investors use to screen potential investments. These criteria cover various aspects, including environmental sustainability, social responsibility, and corporate governance. The impact of ESG on portfolio performance is becoming more evident as data shows that companies with strong ESG practices often outperform their peers.

For example, a 2021 study by the Harvard Business Review found that companies with high ESG ratings tend to have lower volatility and better stock performance over time. This correlation is crucial for investors aiming to balance risk and return in their portfolios.

Larry Fink's Influence on ESG Investing

Larry Fink, CEO of BlackRock, has been a pivotal figure in promoting ESG investing. His annual letters to CEOs emphasize the importance of sustainable practices, urging companies to prioritize long-term value creation over short-term profits. Fink argues that the impact of ESG on portfolio performance is undeniable, with companies that embrace sustainability often yielding better financial returns.

In 2022, BlackRock reported that their ESG-focused funds attracted billions in new investments, reinforcing the idea that investors are increasingly prioritizing sustainability in their portfolio management strategies. Fink’s influence has catalyzed a broader movement toward responsible investing, encouraging both large institutions and individual investors to consider ESG factors.

The Impact of ESG on Financial Returns

Numerous studies illustrate the positive relationship between ESG criteria and financial performance. Research by McKinsey & Company revealed that companies with robust ESG practices could outperform their counterparts by up to 25% in terms of return on equity. This statistic highlights the financial viability of ESG investing.

Real-world examples further emphasize this trend. For instance, Tesla’s commitment to sustainable energy solutions has not only positioned it as a leader in the electric vehicle market but also resulted in significant stock appreciation. Similarly, Unilever’s sustainable living brands are growing faster than its traditional products, showcasing how ESG initiatives can drive financial success.

Challenges and Criticisms of ESG Investing

Despite the growing evidence supporting the impact of ESG on portfolio performance, challenges persist. Some investors argue that ESG metrics can be subjective and difficult to measure. Critics also point to "greenwashing," where companies exaggerate their sustainability efforts to attract investment.

Moreover, there is the misconception that prioritizing ESG factors means sacrificing returns. However, research indicates otherwise. A study published by The Economist in 2023 found that ESG investments can deliver comparable or even superior returns compared to traditional investments, debunking this myth.

Future Trends in ESG and Portfolio Management

The future of ESG investing looks promising. As awareness of climate change and social issues grows, investors are likely to demand more transparency and accountability from companies. Emerging trends include increased regulatory scrutiny and the rise of technology-driven solutions for measuring ESG impact.

Additionally, the integration of artificial intelligence in portfolio management is expected to enhance ESG assessment capabilities. By leveraging big data, investors can make more informed decisions regarding sustainable investments, further solidifying the impact of ESG on portfolio performance.

Conclusion

In summary, the impact of ESG on portfolio performance is significant and multifaceted. By integrating ESG criteria into their investment strategies, investors not only contribute to a more sustainable future but also enhance their financial returns. As trends evolve, understanding the role of ESG in portfolio management will be essential for navigating the investment landscape.

For those looking to further explore ESG investing, consider checking our resources on ESG Investing Strategies and Portfolio Management Techniques. The journey toward sustainable investing is just beginning, and now is the time to get involved.