Understanding The Impact Of Pritzker'S Taxes On Illinois Residents

Illinois Governor J.B. Pritzker's tax policies have sparked conversations about their implications for residents across the state. Understanding the impact of these tax reforms is essential for navigating the financial landscape of Illinois. This article will delve into Pritzker's tax policies, exploring how they affect residents, the state budget, and the economy as a whole.

Overview of Pritzker's Tax Policies

Pritzker's tax reforms have aimed to address various challenges in Illinois. One of the most notable changes is the introduction of a graduated income tax system, which replaces the flat tax structure. This means higher earners pay a larger percentage of their income in taxes. Additionally, Pritzker has focused on increasing funding for public services while aiming to reduce the overall tax burden on middle-class families.

Key Tax Changes Under Pritzker

-

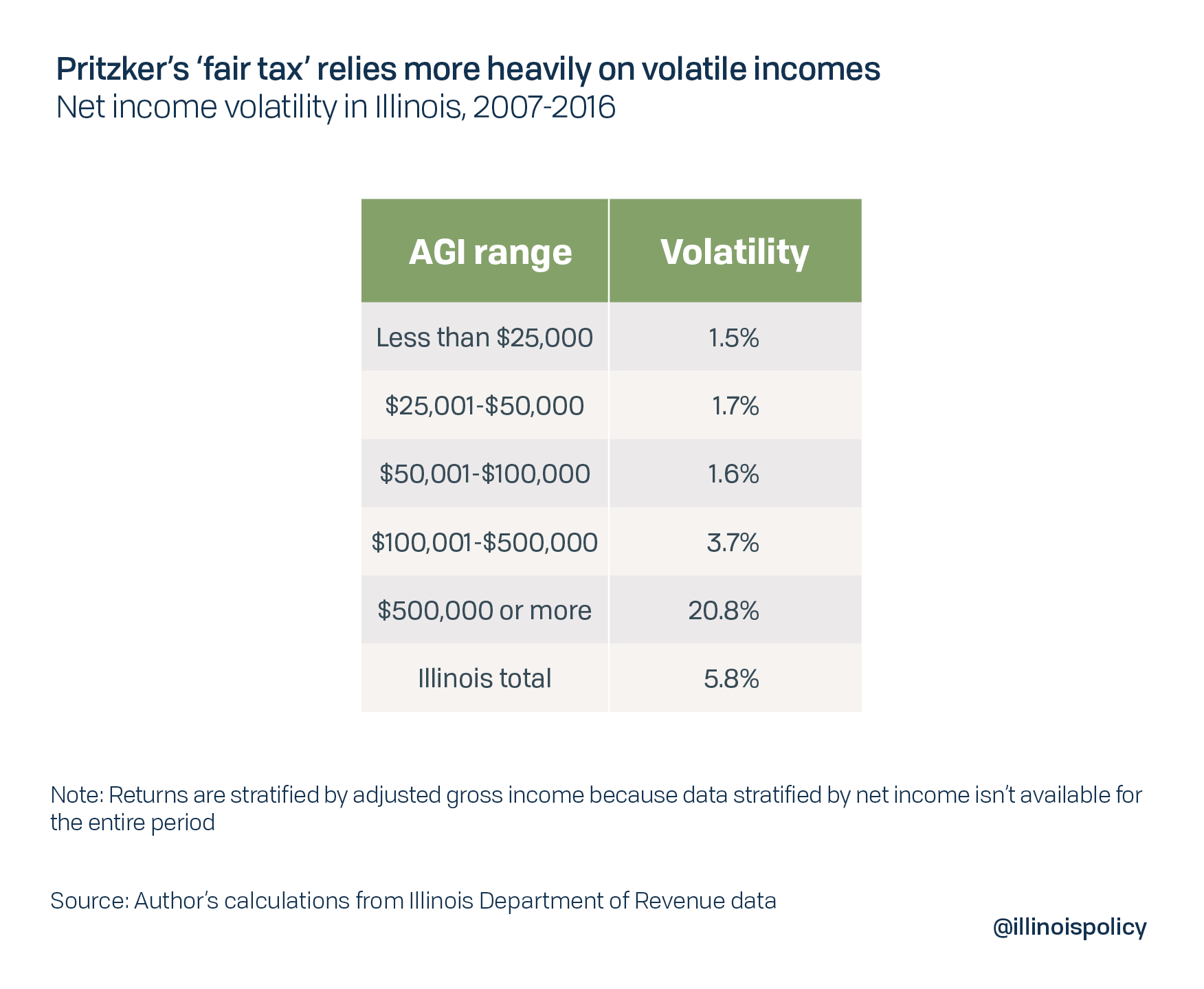

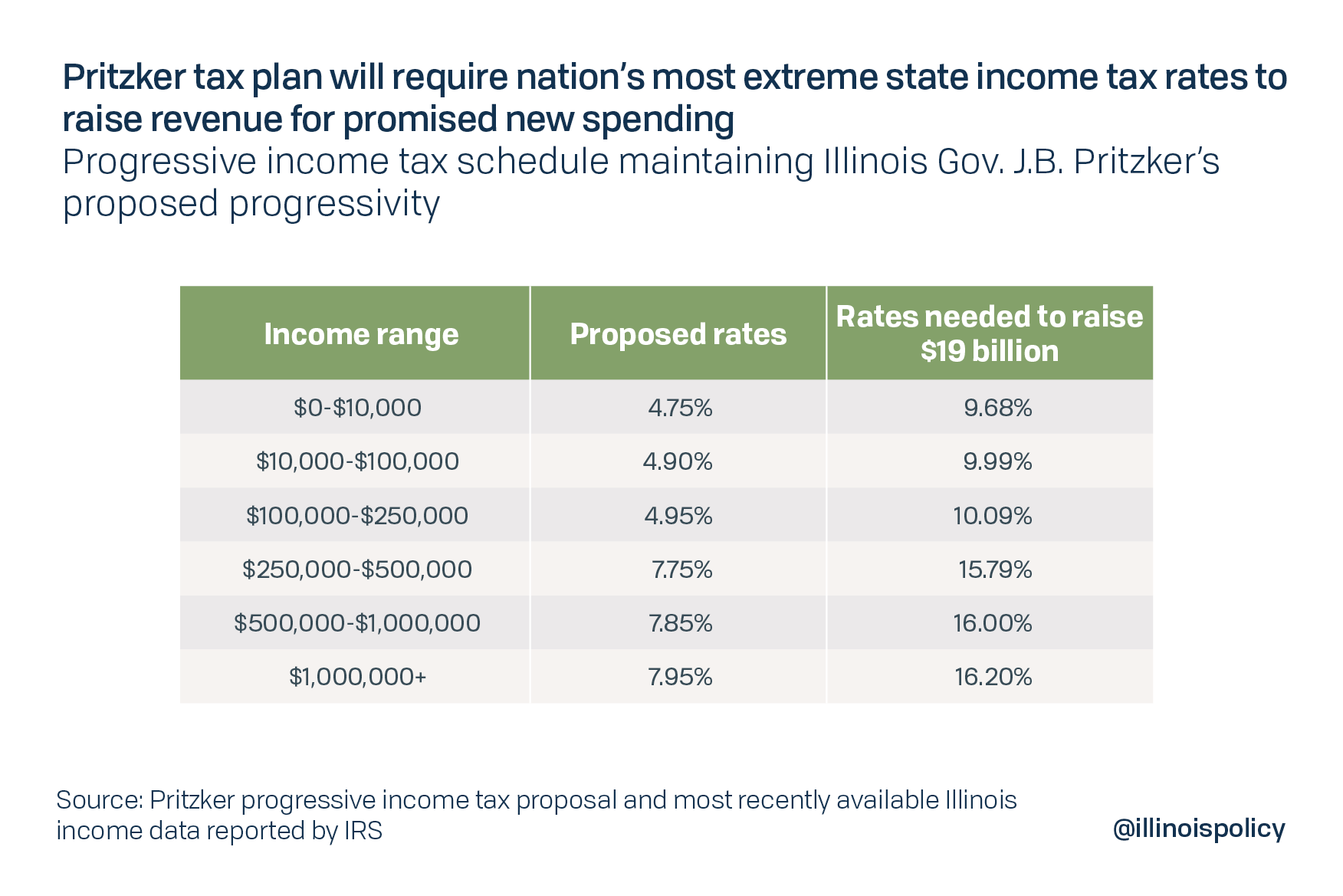

Graduated Income Tax: This system is designed to ensure that those with higher incomes contribute more to the state’s revenue. According to the Illinois Department of Revenue, the new tax brackets range from 4.75% for lower incomes to 7.99% for those earning over $1 million.

-

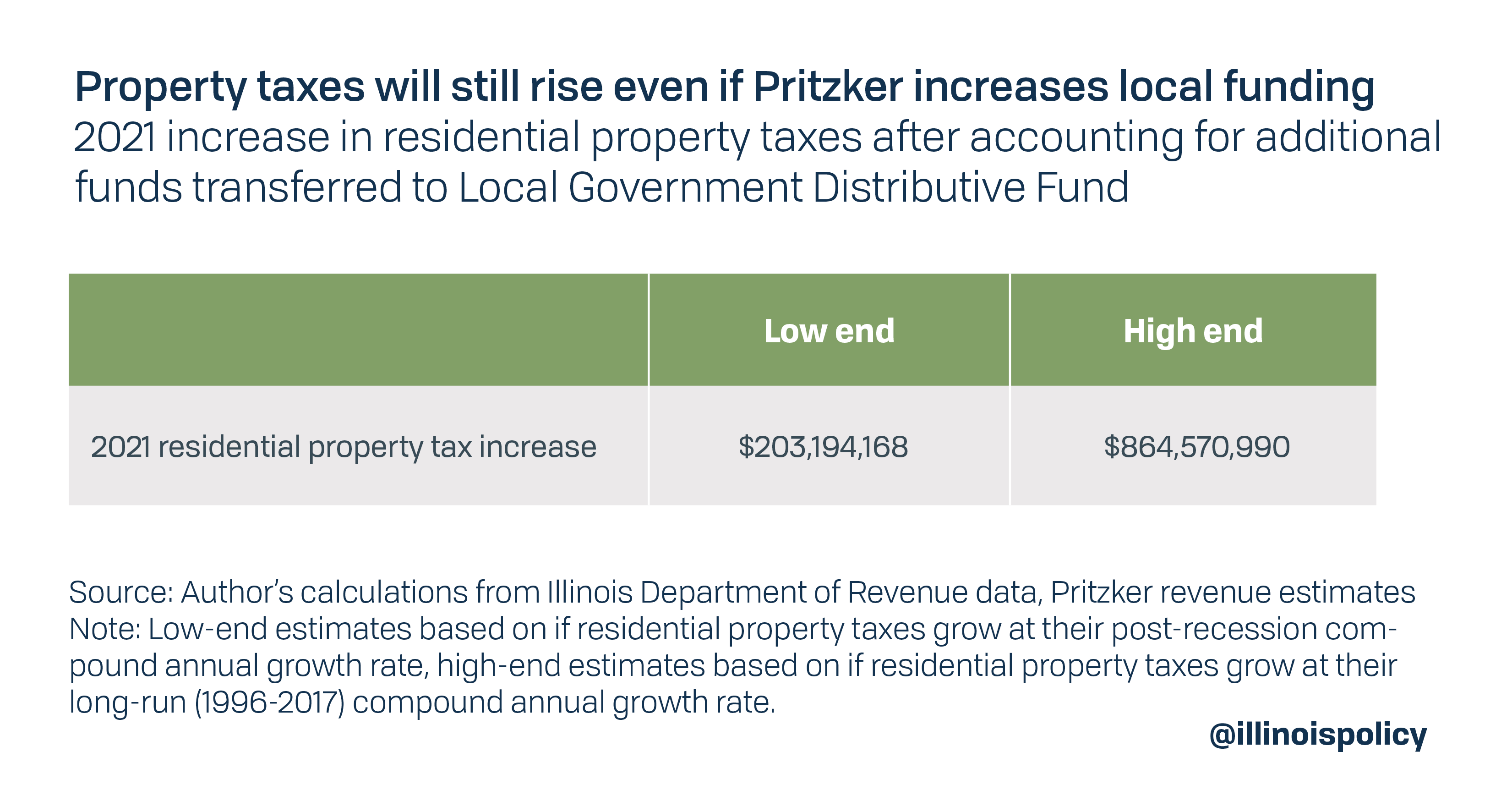

Property Tax Relief: Pritzker's administration has introduced measures to provide property tax relief for homeowners, including the property tax rebate program. This aims to ease the financial strain on residents, particularly those in lower-income brackets.

-

Corporate Tax Adjustments: Changes to corporate tax laws have also been made, with the intention of encouraging businesses to invest in Illinois. By reducing certain tax burdens, the state hopes to attract and retain businesses.

Impact on Residents

Pritzker's tax policies have varied effects on different income brackets within Illinois. Understanding how taxes influence residents is crucial for assessing the overall impact.

How Taxes Affect Different Income Brackets

For low and middle-income residents, the graduated tax system offers some relief compared to the previous flat rate. For example, a family earning $75,000 could see a tax decrease, while higher earners might pay significantly more. The Chicago Tribune reported that approximately 97% of Illinois taxpayers would see no increase in their taxes under the new system.

Conversely, higher-income individuals have expressed concerns about the increased financial burden. Wealthier residents may feel incentivized to relocate to states with lower tax rates, which could lead to a decrease in the state's tax base.

Economic Implications

The economic impact of Pritzker's tax policies extends beyond individual residents. These changes also affect public services and the overall state budget.

Public Services Funded by Taxes

Taxes play a crucial role in funding vital public services in Illinois, such as education, healthcare, and infrastructure. With the anticipated increase in revenue from the graduated income tax, Pritzker’s administration aims to bolster funding for these essential services. For instance, education funding is expected to rise, directly benefiting schools and students across the state.

Moreover, the Tax Foundation has noted that increased funding for public services could stimulate economic growth by improving the quality of life and attracting new residents to Illinois.

Future Outlook

Looking ahead, Pritzker's tax policies may evolve as public opinion and economic conditions change. The state budget challenges and ongoing debates about spending priorities could influence future tax reforms.

Predictions for Future Tax Reforms

Analysts predict that if the graduated income tax proves successful, it could lead to more extensive tax reforms. This might include further adjustments to property taxes or incentives designed to attract businesses. However, the effectiveness of these policies will depend on their ability to balance the needs of residents with the state’s fiscal responsibilities.

Conclusion

In summary, the impact of Pritzker's tax policies on Illinois residents is significant, shaping the financial landscape for many. With changes like the graduated income tax and increased funding for public services, residents can expect both benefits and challenges. Understanding the implications of these reforms is essential for making informed decisions. As Illinois navigates its economic future, staying engaged with these developments will be crucial for all residents.

If you are interested in how Pritzker taxes impact on residents, keep an eye on future reforms and their potential effects on your financial situation.