Unlocking Opportunities: Investing In Emerging Market Trends

Emerging markets present a world of potential for savvy investors. With rapid economic growth and increasing consumer demand, these markets offer unique opportunities that can lead to significant returns. However, investing in emerging market trends requires a nuanced understanding of the landscape. This guide will explore the current trends, driving factors, risks, and strategies to help you navigate this exciting terrain.

Understanding Emerging Markets

Emerging markets are nations with developing economies that show signs of rapid growth and industrialization. They often provide significant investment opportunities due to their expanding middle class, urbanization, and technological advancements. According to the International Monetary Fund (IMF), countries like India, Brazil, and Vietnam are categorized as emerging markets, each presenting distinct advantages for investors.

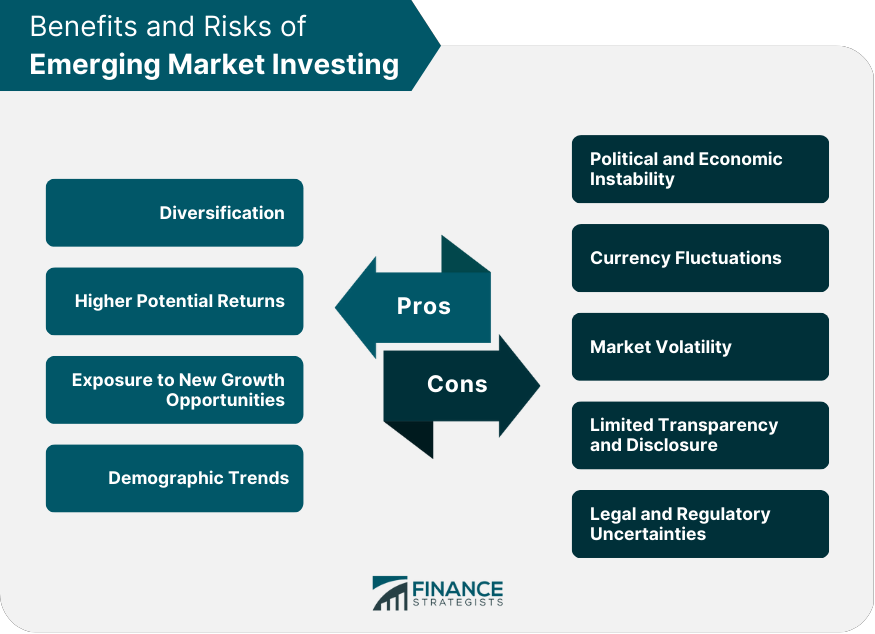

Investing in emerging market trends can diversify your portfolio and provide access to high-growth sectors. However, it’s essential to grasp the unique characteristics of these markets, as they may be more volatile than developed economies.

Current Trends in Emerging Market Investments

Economic Growth Trends

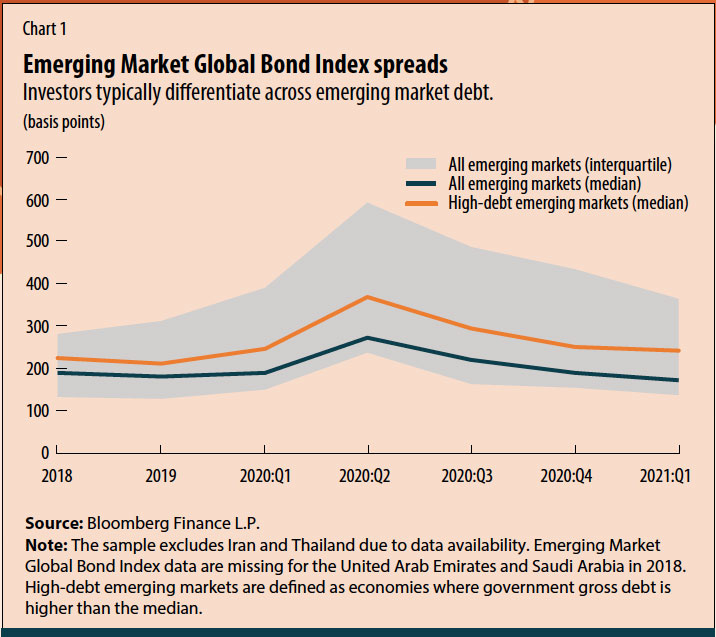

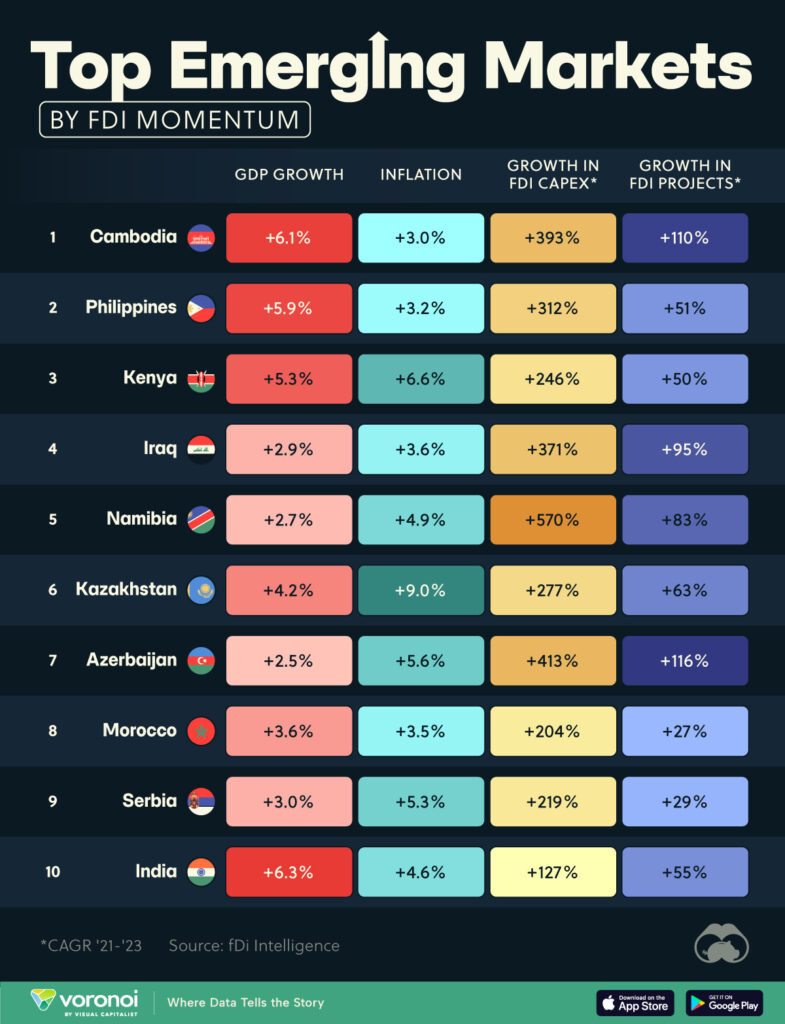

Recent data highlights the robust economic growth in emerging markets. The World Bank projects that emerging economies will grow at a rate of 4.5% in 2024, outpacing global growth. This trend is fueled by increased foreign direct investment (FDI) and government initiatives aimed at infrastructure development.

Technology Adoption

Technology is transforming emerging markets rapidly. Mobile technology, for instance, has leapfrogged traditional infrastructure in countries like Kenya, where mobile payments have revolutionized commerce. As digital platforms expand, investments in tech startups and digital services are becoming increasingly lucrative.

Sustainability Focus

Sustainability is also gaining traction in emerging markets. Investors are looking for opportunities that align with environmental, social, and governance (ESG) criteria. Countries like Brazil are attracting investment in renewable energy projects, making them appealing for socially conscious investors.

Key Factors Driving Growth

Demographic Trends

Demographics play a crucial role in the growth of emerging markets. Young populations and increasing urbanization drive demand for goods and services. For instance, India's youthful demographic is expected to contribute to its economic prowess, making it a hotspot for investment.

Government Policies

Government initiatives can significantly influence investment climates. For example, Vietnam's pro-business policies have attracted many foreign investors, fostering an environment conducive to growth. Understanding these policies is essential for making informed investment decisions.

Global Market Integration

As emerging markets become more integrated into the global economy, they present new opportunities. Countries like Mexico benefit from trade agreements with the U.S., enhancing their market access and fostering growth. This integration makes them attractive for foreign investment.

Risks and Challenges of Investing

Political Instability

Political risk is a significant concern in many emerging markets. Changes in government or policy can create uncertainty. For example, investors in Turkey faced challenges due to political shifts affecting economic policies. Conducting thorough research and staying informed can help mitigate these risks.

Currency Fluctuations

Currency volatility can impact investment returns. For instance, the depreciation of the Argentine peso has affected foreign investments. Investors should consider hedging strategies or diversifying currency exposure to manage this risk effectively.

Infrastructure Deficiencies

Infrastructure is often lacking in emerging markets, which can hinder economic growth. However, investment in infrastructure projects can yield substantial returns. For instance, China’s Belt and Road Initiative aims to enhance connectivity across Asia, creating opportunities for investors.

Strategies for Successful Investment

Diversification

Diversification is key when investing in emerging markets. Spreading investments across different sectors and countries can reduce risk. For example, investing in both agriculture and technology sectors in India can balance potential returns.

Research and Due Diligence

Conducting thorough research is vital before making investment decisions. Investors should analyze economic indicators, local market conditions, and government policies. Resources like the World Bank and IMF provide valuable data for informed decision-making.

Partnering with Local Experts

Collaborating with local investment firms or experts can provide insights that enhance investment strategies. For instance, local firms may have a better understanding of consumer behavior and market dynamics, which can lead to more informed investment choices.

Conclusion

Investing in emerging market trends offers a wealth of opportunities for those willing to navigate the complexities involved. By understanding current trends, economic growth factors, and the associated risks, investors can make informed decisions that lead to success. As the global economy continues to evolve, now is the time to explore these dynamic markets. Consider investing in emerging markets to unlock potential growth in your portfolio.

Call to Action

Ready to explore the vast opportunities in emerging markets? Start your journey today by researching potential investments and reaching out to local experts to guide you through the process. The future of investing is in emerging markets—don’t miss out on your chance to capitalize on this growth!