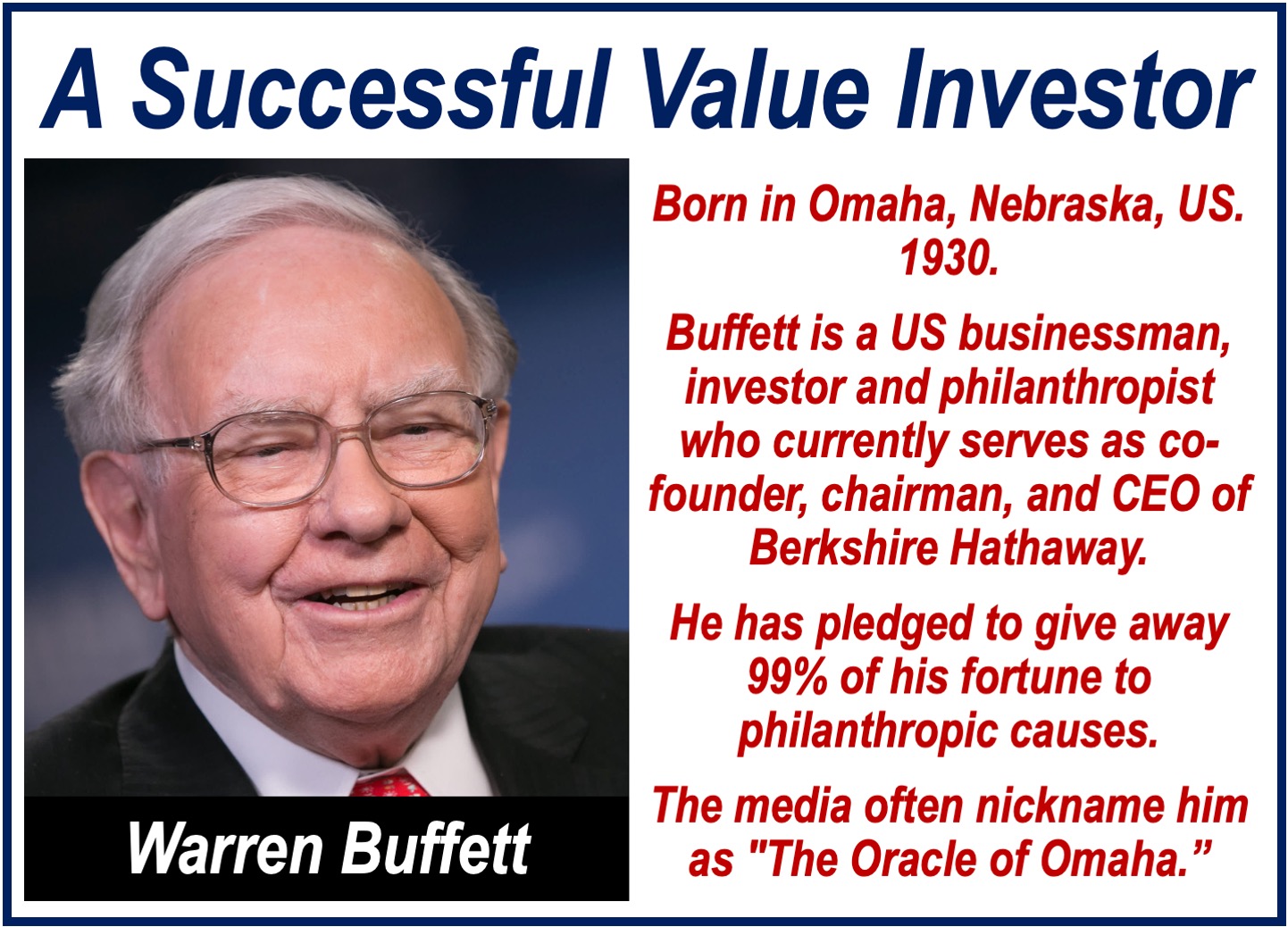

Unlocking Warren Buffett'S Value Investing Secrets

Warren Buffett, often referred to as the "Oracle of Omaha," is one of the most successful investors in history. His unique approach to investing has not only delivered astounding returns but has also educated countless individuals on the principles of financial literacy. This guide will delve into the core concepts of Warren Buffett’s value investing strategies, offering insights that can help both novice and intermediate investors thrive in the stock market.

Introduction to Warren Buffett's Value Investing

Warren Buffett's investment philosophy centers on the idea of value investing, which focuses on buying securities that appear underpriced relative to their intrinsic value. This approach emphasizes thorough analysis and a long-term perspective, setting it apart from more speculative forms of investing. By understanding Buffett's principles, investors can make smarter decisions that lead to sustainable wealth.

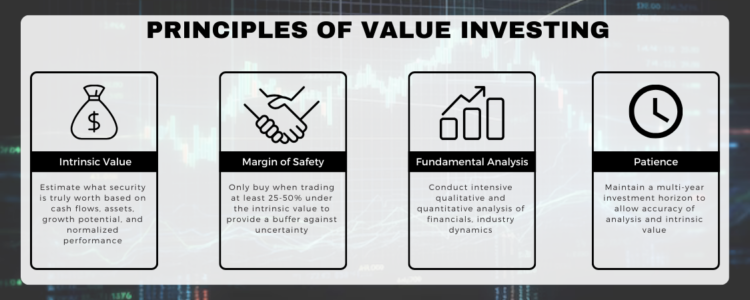

Key Principles of Value Investing

Warren Buffett's investment principles serve as the foundation for his success. Here are some key tenets:

-

Invest in What You Understand: Buffett advocates for investing in businesses that are familiar to you. This knowledge helps in making informed decisions.

-

Look for Value: Identify stocks that are undervalued compared to their intrinsic worth. A strong focus on price-to-earnings ratios and other financial metrics is essential.

-

Long-Term Perspective: Patience is key. Buffett believes in holding investments for the long haul to ride out market fluctuations.

-

Quality over Quantity: Focus on high-quality companies with strong management and a competitive edge.

-

Margin of Safety: Always invest with a cushion. This protects your investment against unforeseen market downturns.

By adhering to these principles, Buffett has consistently outperformed the market.

Understanding Economic Moats

An economic moat refers to a company's ability to maintain a competitive advantage over its rivals, ensuring long-term profits and market share. This concept is crucial in Buffett's investment strategy. Companies with strong economic moats possess unique characteristics, such as brand loyalty, cost advantages, or proprietary technology.

Examples of Companies with Strong Economic Moats:

-

Coca-Cola: With its iconic brand and global distribution network, Coca-Cola enjoys significant brand loyalty and market penetration.

-

American Express: This financial services company has established trust and a dedicated customer base, giving it a competitive edge in the credit card market.

-

Apple: Known for its innovative products and strong brand, Apple has developed a loyal customer base that consistently drives sales.

Understanding economic moats helps investors identify companies with the potential for sustainable growth.

Buffett's Investment Strategy

Buffett employs a meticulous approach to evaluating companies. He emphasizes the importance of fundamental analysis, focusing on financial statements, business models, and market trends. Additionally, he considers the following elements:

-

Risk Management: Buffett carefully assesses risks associated with each investment, ensuring he is not overexposed to any singular market event.

-

Long-Term Thinking: He advocates for holding investments for years, allowing them to grow and compound.

-

Capital Allocation: Buffett is strategic in deploying capital to maximize returns. He prefers businesses that generate strong cash flows, enabling reinvestment or dividends.

By following these strategies, investors can make informed and effective investment decisions.

Practical Applications for Investors

For those looking to apply Warren Buffett’s strategies, here are actionable tips:

-

Start with Education: Read books like "The Intelligent Investor" by Benjamin Graham to understand fundamental investment principles.

-

Analyze Financial Statements: Familiarize yourself with key metrics like P/E ratios, debt-to-equity ratios, and cash flow statements.

-

Invest in Index Funds: If you're unsure about picking individual stocks, consider investing in index funds that track the overall market.

-

Diversify Your Portfolio: Spread your investments across various sectors to minimize risk.

Case Studies:

-

Coca-Cola: Buffett began investing in Coca-Cola in 1988 when shares were traded at a low P/E ratio. Today, Coca-Cola remains one of his most successful investments.

-

American Express: After the company faced financial difficulties in the 1960s, Buffett saw an opportunity and invested heavily, resulting in substantial returns over the decades.

These examples illustrate how a disciplined application of Buffett's principles can yield impressive results.

Conclusion

Warren Buffett's value investing strategies provide a roadmap for anyone looking to enhance their financial literacy and investment acumen. By understanding his principles—such as investing in what you know, recognizing economic moats, and adopting a long-term perspective—investors can navigate the complexities of the stock market more effectively. To learn more about these strategies and start your investment journey, explore additional resources on value investing and market analysis. Your path to financial success begins with informed decisions today!