Navigating Car Financing Options: A Comprehensive Guide

Buying a car can be exciting, but understanding your car financing options is crucial. With so many choices available, it’s easy to feel overwhelmed. This guide will help you navigate through various financing methods, empowering you to make informed decisions that best suit your financial situation.

Introduction to Car Financing Options

Car financing refers to the process of borrowing money to purchase a vehicle. It is important because most people cannot pay for a car outright. Understanding your financing options can save you money and help you avoid costly mistakes. The main types of financing include auto loans, leasing, and personal loans. Each option has its benefits and drawbacks, which we’ll explore in detail.

Understanding Different Types of Car Financing

When it comes to car financing options, knowing the different types available can make all the difference.

Types of Car Loans

-

Direct Lending: This involves borrowing money from a bank or credit union. It typically offers lower interest rates compared to dealership financing. For example, in 2025, average interest rates for auto loans are projected to be around 4.5% for buyers with good credit.

-

Dealership Financing: Many dealerships offer financing options through partnerships with banks. While this can be convenient, it may come with higher interest rates. Always compare these rates with direct lenders to ensure you’re getting a good deal.

-

Personal Loans: These are unsecured loans that can be used for any purpose, including vehicle purchases. However, they usually come with higher interest rates than traditional auto loans, making them less appealing for car financing.

Leasing vs. Buying

Another significant decision is whether to lease or buy a vehicle.

-

Leasing typically requires lower monthly payments and allows you to drive a new car every few years. However, you won’t own the vehicle at the end of the lease term.

-

Buying, on the other hand, means you eventually own the car and can drive it for as long as you want. While monthly payments may be higher, you build equity over time.

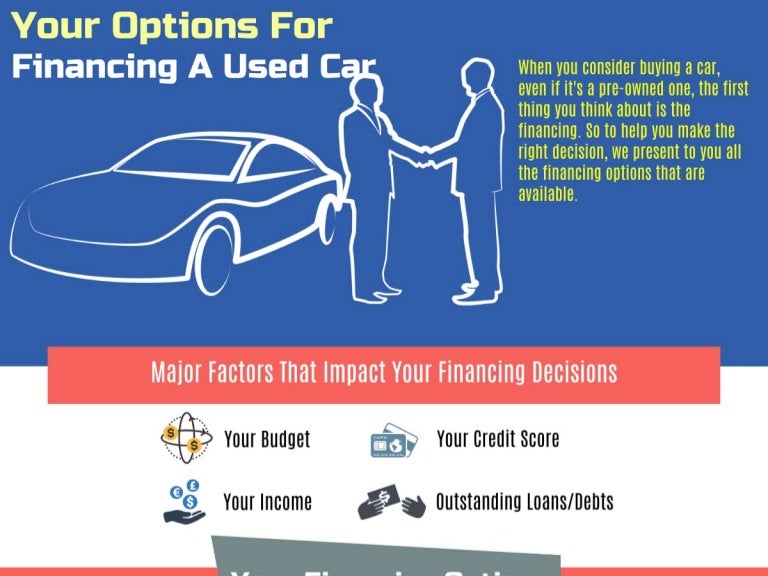

Factors Affecting Car Financing

Several factors can influence your car financing options, particularly your credit score and interest rates.

Importance of Credit Score

Your credit score plays a significant role in determining your financing options. Lenders use this score to assess your creditworthiness. A higher credit score often leads to better interest rates. For instance, individuals with scores above 740 can expect rates around 3.5%, while those with scores below 600 may face rates exceeding 10%.

Interest Rates and Loan Terms

Interest rates can vary significantly based on market conditions and individual credit profiles. Loan terms also impact your monthly payments. Typically, longer loan terms result in lower monthly payments but higher overall interest paid. For example, a five-year loan may have a lower monthly payment than a three-year loan, but you’ll pay more in total interest.

Steps to Secure Car Financing

Securing financing for your vehicle doesn't have to be daunting. Follow these steps to ensure you’re well-prepared.

Preparing for Financing

-

Check Your Credit Score: Before applying for a loan, check your credit score and report any discrepancies.

-

Set a Budget: Determine how much you can afford to spend on monthly payments.

-

Research Lenders: Compare interest rates and terms from various lenders, including banks, credit unions, and dealerships.

Getting Pre-Approved

Getting pre-approved for a loan can streamline your car-buying process.

-

Apply for Pre-Approval: Submit applications to multiple lenders to compare offers.

-

Negotiate Terms: Don’t hesitate to negotiate interest rates and terms with lenders.

Documents Needed for Financing

When applying for financing, you’ll need several documents, including:

- Proof of identity (driver’s license or passport)

- Proof of income (pay stubs or tax returns)

- Information about your credit history

- The vehicle identification number (VIN) if you have a specific car in mind

Conclusion

Navigating car financing options doesn’t have to be overwhelming. Whether you choose to lease or buy, understanding your choices can lead to better financial decisions. Remember to consider your credit score, compare interest rates, and prepare your documents before applying for financing. Take the first step today—explore your financing options and drive away with confidence!