The Influence Of Ken Griffin And Citadel On Financial Markets

In the complex world of finance, few names resonate as powerfully as Ken Griffin and his firm, Citadel LLC. Known for its innovative approaches and market-making prowess, Citadel has significantly impacted financial markets, shaping trading volumes and liquidity. This article delves into the market impact of Ken Griffin and Citadel, exploring their strategies, regulatory challenges, and future trends.

Citadel's Market Impact

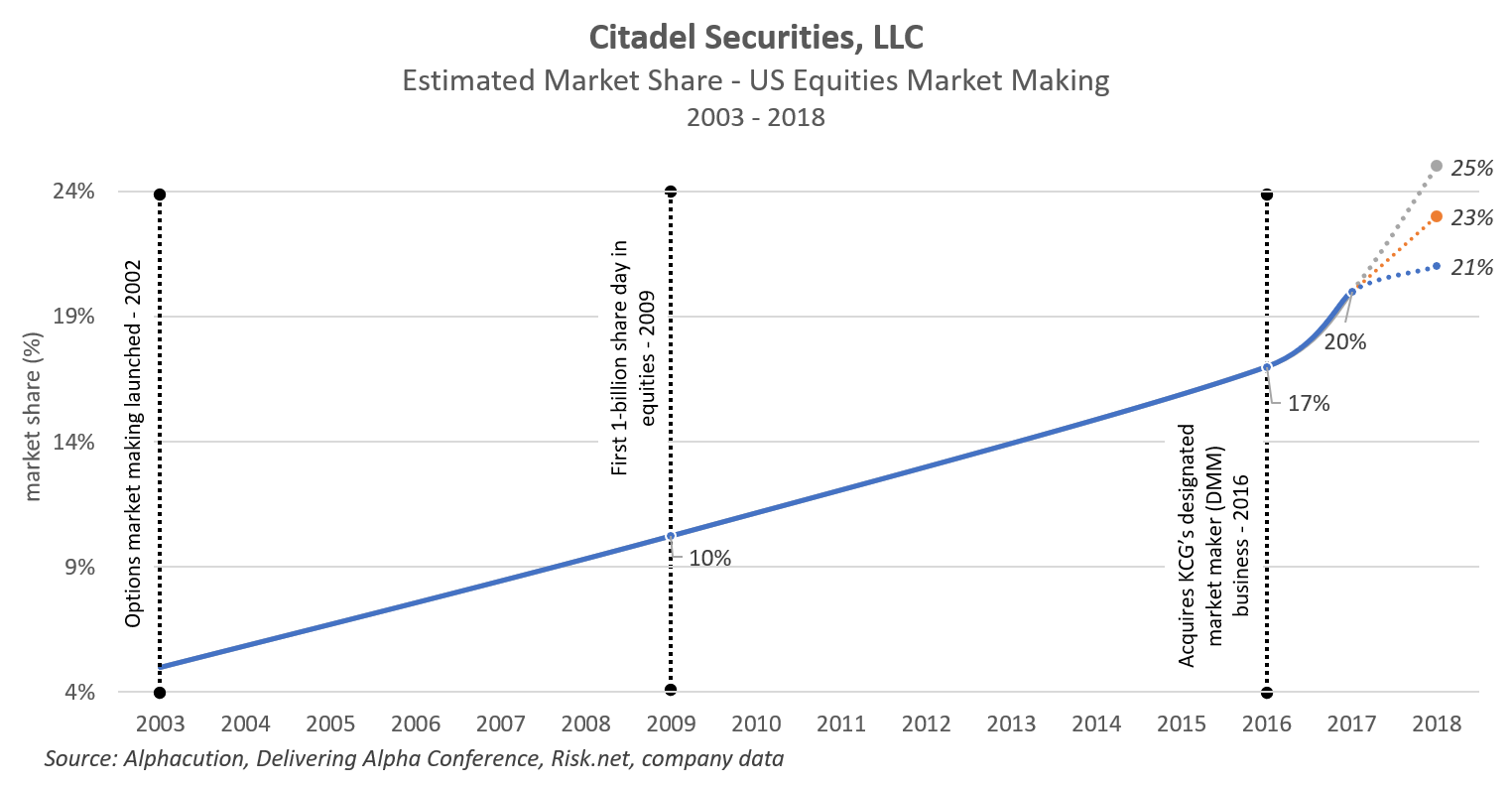

Citadel Securities, a subsidiary of Citadel LLC, plays a crucial role in market making. As one of the largest market makers in the world, Citadel Securities handles a substantial portion of equity trading in the United States. In fact, it accounted for nearly 27% of all U.S. equity trading volume in 2022. By enhancing market liquidity, Citadel ensures that buyers and sellers can execute trades quickly and efficiently.

For example, during the GameStop trading frenzy in early 2021, Citadel's role as a market maker became particularly prominent. The firm facilitated the rapid trading activity that characterized the event, showcasing its ability to handle high volumes while maintaining market stability. This incident highlighted Citadel's influence on market dynamics and the importance of liquidity in times of volatility.

Investment Strategies Employed by Citadel

Citadel employs diverse investment strategies that contribute to its market impact. One of its core strategies is high-frequency trading (HFT), which involves executing a large number of orders at extremely high speeds. By leveraging advanced algorithms and technology, Citadel can capitalize on minute price discrepancies across various markets.

Another successful strategy is statistical arbitrage, where Citadel identifies and exploits inefficiencies in pricing between related securities. For instance, the firm's quantitative research teams analyze vast amounts of data to predict price movements, which has led to significant returns over time. Citadel's ability to adapt and innovate in its investment strategies has solidified its position as a leader in the financial sector.

Regulatory Environment and Challenges

The regulatory landscape significantly affects Citadel's operations. As a major player in the financial markets, Citadel must navigate complex regulations set forth by bodies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations aim to ensure fair trading practices and protect investors.

However, Citadel has faced scrutiny over its practices. For example, its involvement in payment for order flow (PFOF) has raised questions about conflicts of interest. Critics argue that this practice may compromise the quality of trade execution for retail investors. In response, Citadel has emphasized its commitment to transparency and compliance, highlighting its role in enhancing market efficiency.

Future Outlook for Citadel and Market Trends

Looking ahead, Citadel is poised to continue influencing financial markets. The firm is likely to expand its capabilities in areas like artificial intelligence and machine learning, enhancing its trading strategies and market analysis. As financial markets evolve, the demand for innovative solutions will only grow.

Moreover, with increasing regulatory scrutiny, Citadel will need to adapt its practices while maintaining its competitive edge. Insights from industry experts suggest that firms that prioritize compliance and transparency will thrive in the evolving landscape. Citadel's proactive approach to regulation may position it favorably for the future.

Conclusion

In summary, Ken Griffin and Citadel have undeniably shaped the landscape of financial markets through their innovative approaches and strategic investment practices. From their significant market-making role to the challenges they face in a complex regulatory environment, Citadel's impact on trading volume and liquidity is profound. As we look to the future, Citadel's adaptability and commitment to excellence will be crucial in navigating the changing tides of the financial world. For investors and financial professionals alike, understanding the dynamics of Citadel's operations offers valuable insights into the broader market landscape.

If you're interested in further exploring the intricacies of financial markets, consider following developments in market-making strategies and regulatory changes. The evolution of firms like Citadel will continue to influence investment strategies and market dynamics for years to come.