Navigating Stock Market Trends: Insights From Jim Cramer

The stock market can often feel like a maze, filled with twists and turns that challenge even seasoned investors. Understanding stock market trends is essential for making informed investment decisions. Jim Cramer, the charismatic host of CNBC's "Mad Money," has earned a reputation for his keen insights into market dynamics. This article explores Jim Cramer stock market trends, providing valuable insights to help investors navigate the complexities of the financial world.

Who is Jim Cramer?

Jim Cramer is a former hedge fund manager turned television personality. His expertise in stock market analysis has made him a trusted figure for many investors. Through his show on CNBC, Cramer shares his extensive knowledge of financial markets, helping viewers make sense of market movements. He combines years of investing experience with an engaging style, making financial news insights accessible to a broad audience.

Understanding Stock Market Trends

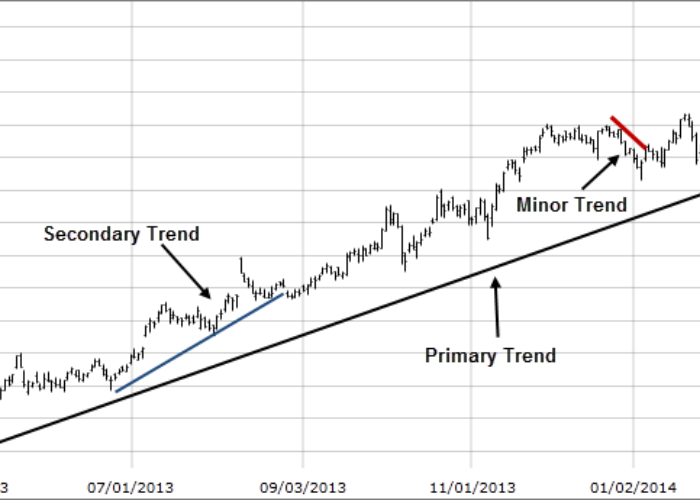

Stock market trends reflect the overall direction of the market over time. Key indicators, such as moving averages and volume, help investors understand these trends. For example, a rising moving average may indicate a bullish market, suggesting that stock prices are likely to continue increasing.

Understanding stock market trends allows investors to identify opportunities and avoid potential pitfalls. For instance, when market volatility spikes, it often signals uncertainty. By analyzing these indicators, investors can make more informed decisions during turbulent times.

Jim Cramer's Approach to Market Analysis

Cramer's market analysis revolves around both technical and fundamental strategies. His approach emphasizes understanding company fundamentals, such as earnings reports and growth potential. Cramer often advises investors to look at the bigger picture, considering how global events impact local markets.

For example, Cramer has famously warned about potential downturns based on geopolitical tensions. He often suggests watching sectors that may benefit from these shifts. This dual approach allows investors to anticipate market moves and position their portfolios wisely.

Investment Strategies for 2025

As we look ahead to 2025, Cramer’s investment strategies are crucial for navigating anticipated market challenges. He typically distinguishes between long-term and short-term investments.

For long-term investors, Cramer advocates for stocks in sectors poised for growth, such as technology and renewable energy. Conversely, for short-term traders, he recommends focusing on stocks that exhibit strong momentum. Notably, Cramer’s stock picks often include companies like Apple and Tesla, which have shown resilience during market fluctuations.

Market Volatility Analysis

Understanding market volatility is essential for any investor. Cramer emphasizes the importance of assessing economic indicators, such as unemployment rates and inflation, to gauge market stability. For instance, during times of high inflation, Cramer often advises caution and suggests diversifying into more stable investments.

By analyzing these trends, investors can better prepare for potential downturns. Cramer’s insights into how market volatility affects different sectors can guide investors in making timely decisions.

Conclusion

In summary, Jim Cramer’s insights into stock market trends provide a valuable roadmap for investors. By understanding his methodologies and strategies, investors can navigate the complexities of the financial landscape more effectively. Whether you’re a novice or an experienced trader, keeping an eye on Cramer’s stock picks can enhance your investment decisions.

For those looking to refine their approach to the stock market, following Jim Cramer’s insights can be a game-changer. Start today by incorporating his strategies into your investment journey and watch your financial acumen grow.