Navigating Sustainable Investment Strategies: A Comprehensive Guide

In today's financial world, investors face a crucial choice: prioritize profits or support sustainable practices. Enter sustainable investment strategies, which allow investors to achieve both goals. This guide will explore the fundamentals of sustainable investments, focusing on Environmental, Social, and Governance (ESG) criteria, and provide insights from industry leaders like BlackRock. By understanding these strategies, you can make informed decisions that benefit both your portfolio and the planet.

Introduction to Sustainable Investment Strategies

Sustainable investment strategies involve selecting investments based on their environmental, social, and governance impact. As global awareness of climate change and social justice rises, investors increasingly seek ways to align their portfolios with their values. These strategies not only aim for financial returns but also work towards a more sustainable future. In this guide, we will delve into the key components of sustainable investment strategies, showcasing their importance in today’s financial landscape.

Understanding ESG Criteria

ESG criteria are essential in evaluating the sustainability and ethical impact of investments. They encompass three main areas: Environmental, Social, and Governance.

Environmental Factors

This component considers how a company performs as a steward of nature. For instance, does it manage its carbon footprint effectively? Companies that prioritize renewable energy sources or sustainable resource management often attract ESG-minded investors.

Social Factors

Social criteria examine how a company manages relationships with employees, suppliers, customers, and the communities where it operates. A firm that promotes diversity or engages in fair labor practices can enhance its social standing, making it more appealing to ethical investors.

Governance Factors

Governance looks at a company’s leadership, transparency, and shareholder rights. Strong governance practices, such as independent board members and ethical decision-making, can significantly influence investment decisions.

Real-world examples abound. For instance, Tesla's focus on electric vehicles and sustainable energy has positioned it as a leader in both innovation and ethical investing.

BlackRock's Approach to Sustainable Investing

BlackRock, a global investment management corporation, champions sustainable investing. Their philosophy emphasizes long-term value creation aligned with sustainability. According to BlackRock's official website, they integrate ESG factors into their investment decisions, believing that sustainable companies are better positioned for success.

In 2022, BlackRock launched several ESG-focused funds, including those that invest in renewable energy and sustainable agriculture. Their commitment illustrates how large financial institutions are pivoting towards responsible investing, influencing market trends significantly.

Benefits of Sustainable Investment Strategies

Adopting sustainable investment strategies offers numerous advantages:

- Financial Performance: Research indicates that companies with strong ESG practices often outperform their peers.

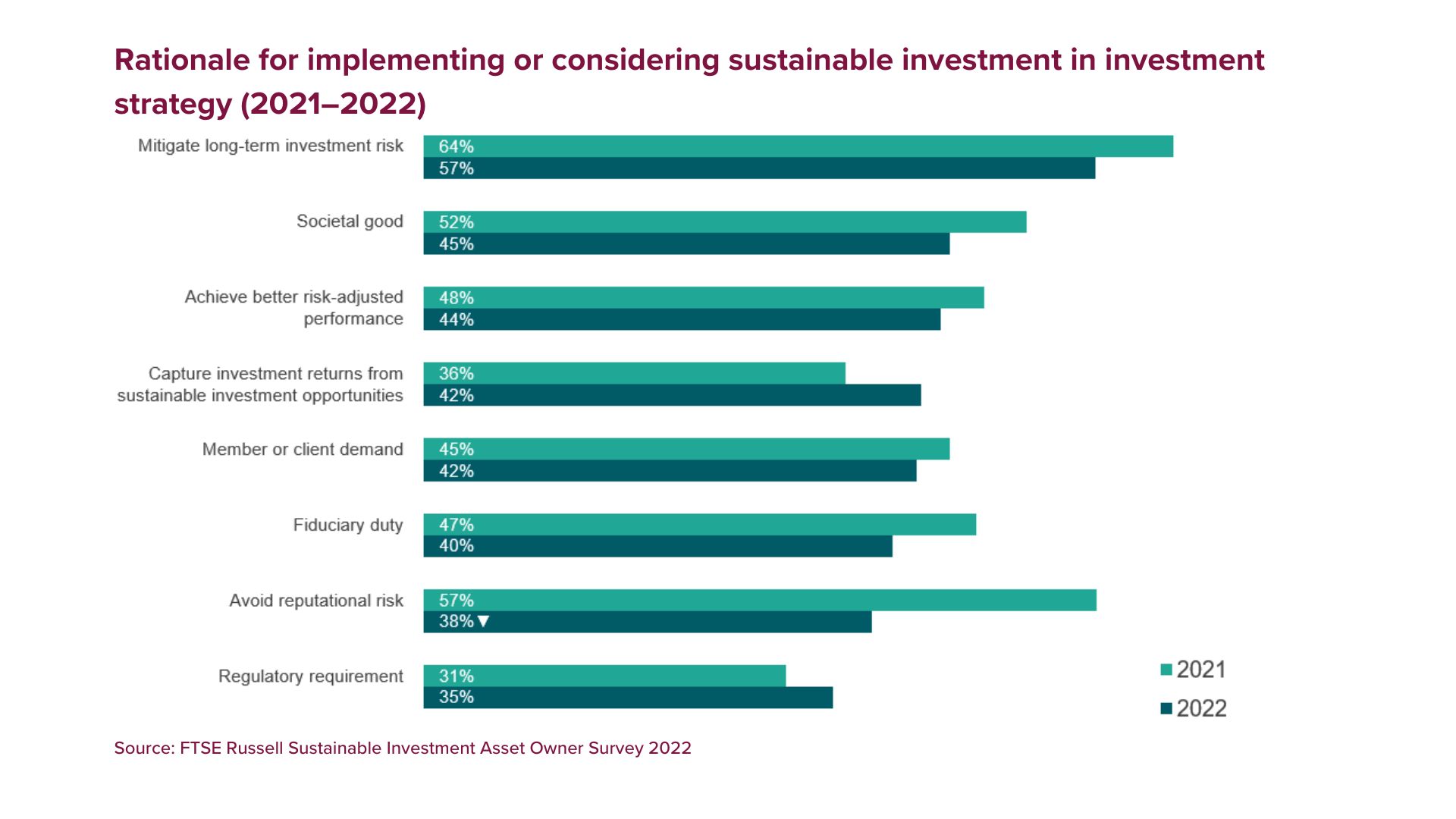

- Risk Mitigation: Sustainable investments can provide a buffer against environmental and social risks.

- Alignment with Values: Investors can support causes they care about while still aiming for financial gain.

- Market Demand: As consumer preferences shift towards sustainability, companies that prioritize ESG factors may benefit from increased demand.

These points highlight why more investors are gravitating towards sustainable investing.

Challenges in Sustainable Investing

Despite its benefits, sustainable investing comes with challenges. Investors often face hurdles such as:

- Data Availability: Reliable ESG data is not always accessible, making it difficult to evaluate potential investments.

- Greenwashing: Some companies exaggerate their sustainability efforts, leading to misleading investment choices.

- Market Volatility: Sustainable sectors may experience fluctuations in response to policy changes or economic shifts.

A notable example includes the backlash against certain renewable energy investments during fluctuating oil prices, highlighting the risks involved.

Future Trends in Sustainable Finance

The landscape of sustainable finance is ever-evolving. By 2025, we anticipate several key trends shaping the industry:

- Increased Regulation: Governments are likely to implement stricter regulations around ESG disclosures.

- Technological Innovation: Advancements in technology will provide better tools for analyzing and tracking ESG performance.

- Growing Demand for Impact Investing: More investors are looking to make a positive social or environmental impact through their investments.

Organizations like the Global Reporting Initiative and the Sustainability Accounting Standards Board are leading the charge in promoting transparency and accountability in ESG reporting.

Conclusion

Sustainable investment strategies are not just a trend; they represent the future of finance. By understanding ESG criteria and the approaches of industry leaders like BlackRock, investors can make informed decisions that align with their values while still achieving financial success. As you explore sustainable investing, consider how these strategies can enhance both your portfolio and the world around you. Start your sustainable investment journey today—your choices can lead to a more sustainable future for all.