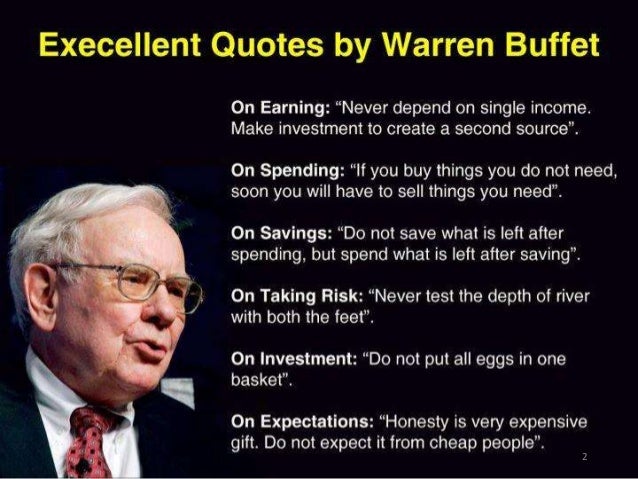

Unlocking Warren Buffett'S Investment Strategies: A Comprehensive Guide

Warren Buffett, often called the "Oracle of Omaha," has become a legendary figure in the world of investing. His investment strategies have not only built his fortune but have also inspired countless investors worldwide. In this guide, we will explore Warren Buffett's investment strategies, focusing on his principles of value investing, stock selection criteria, and the importance of long-term thinking. By understanding these strategies, you can improve your own investment approach.

Introduction to Warren Buffett's Investment Strategies

Warren Buffett, the CEO of Berkshire Hathaway, is known for his ability to identify undervalued companies and hold them for the long term. His insight and financial wisdom have made him a role model for many investors. This guide aims to break down Buffett's investment strategies, helping you grasp the concepts that can lead to financial success.

Key Principles of Value Investing

Value investing is a strategy that involves buying stocks that appear to be undervalued in the market. Buffett emphasizes the importance of understanding a company's intrinsic value before investing. He believes that a good investment is one that can be held for many years, allowing it to mature and grow.

For example, Buffett invested in Coca-Cola in 1988 when the stock price was around $2.45 per share. At that time, he recognized Coca-Cola's strong brand, global presence, and competitive advantage. Today, that investment has significantly multiplied, showcasing his value investing principles.

Warren Buffett's Approach to Stock Selection

Buffett has a meticulous approach to stock selection. He focuses on companies with strong fundamentals, including a solid management team and a competitive advantage, often referred to as an "economic moat." Key metrics he considers include:

- Earnings Growth: Consistent earnings growth indicates a healthy company.

- Return on Equity (ROE): High ROE demonstrates efficient management.

- Debt Levels: Low debt levels reduce financial risk.

A prime example is Buffett's investment in American Express. He recognized the company's strong brand and customer loyalty, despite temporary setbacks. This strategic choice has paid off handsomely over the years.

The Importance of Long-Term Thinking

Buffett is a strong proponent of long-term investing. He famously said, "Our favorite holding period is forever." This mindset encourages investors to remain patient, allowing their investments to compound over time.

Consider Buffett's investment in Geico. He initially invested in the company in 1976. Despite market fluctuations, he held onto his shares, ultimately reaping substantial rewards as Geico grew into a major player in the insurance industry. His long-term thinking exemplifies the value of patience in investing.

Case Studies of Successful Investments

Let's examine four notable investments made by Buffett and analyze what made them successful:

-

Coca-Cola: As mentioned earlier, Buffett's investment in Coca-Cola highlighted his belief in strong brands. His commitment to the company has yielded impressive returns.

-

Apple: Buffett's investment in Apple has been one of his most profitable. He recognized Apple's brand loyalty and its ability to innovate, leading to outstanding growth.

-

Wells Fargo: Although this investment faced challenges, Buffett's initial judgment of the bank's strong fundamentals and potential for recovery proved correct over time.

-

BNSF Railway: Buffett invested in BNSF because of its essential role in the U.S. economy. His foresight in recognizing the value of infrastructure led to significant long-term gains.

These case studies illustrate Buffett's disciplined approach and the effectiveness of his investment strategies.

Conclusion: Applying Buffett's Strategies Today

In summary, Warren Buffett's investment strategies are rooted in value investing principles, a keen focus on stock selection, and a commitment to long-term thinking. By understanding these concepts, you can make informed investment decisions that align with Buffett's proven philosophy. Start applying these strategies today to enhance your investing journey and potentially achieve financial success.

Investing can seem daunting, but by following in the footsteps of Warren Buffett, you can cultivate a rewarding investment experience. Embrace value investing, think long-term, and stay disciplined. Your financial future may thank you for it!